Advanced Foreign Currency Valuation

Advanced Foreign Currency Valuation is part of Advanced Valuation in Financial Accounting. Advanced Valuations support you in following accounting standards, for example, IFRS9. The following processes are part of advanced valuation and are realized as job templates in the Schedule General Ledger Jobs app.

1. Post Discounting of Long-Term Assets and Liabilities

2. Advanced Foreign Currency Valuation

3. Post Credit-Risk Based Impairment

In this blog we will be focussing only on Advanced Foreign Currency Valuation in S/4HANA Public Cloud.

Overview for quick understanding of Advanced FCV

- No reversal posting in FCV process, values are changed as delta to previous run

- Only gain and loss accounts are configured for Realized and Unrealised. Simplified account determination. No original (Recon/ banks etc.) and adjustment accounts are required to configure.

- Posting to original accounts (Recon GL, Bank G/L, Other liability G/L etc.)

- Grouping rules for valuation of several items. E.g., Grouping = if there is an invoice and it has a debit/credit note also then both will be a group together. There will be one FC valuation posting for the group.

- Parallel accounting and valuation posting into all currency types

- Link between valuation journal entry and original journal entry

- Processing status details per line item – transparency of calculation

- If you are a new customer or existing customer and about to add new country version to your system using the Central Business Configuration (CBC), please be aware that Advanced Valuation is automatically activated for this new country. If you want to use classic valuations you can always deactivate advanced valuation in the Activate Advanced Valuation configuration item, if you don´t have any postings for that newly added country in our productive system yet.

- Decision is very crucial to use or not to use Advanced FCV as you cannot go back once you’ve activated Advanced Valuation in Financial Accounting for a ledger and company code in an accounting principle, and after you’ve made postings, you can no longer deactivate Advanced Valuation in Financial Accounting for this ledger and company code.

- It is part of Scope item J58 (Accounting and Financial Close)

- Advanced Foreign Currency Valuation job template in Schedule General Ledger Jobs is the replacement for (1) Foreign Currency Valuation job template and (2) Perform Foreign Currency Valuation app

- You would still be able to run Perform Foreign Currency Valuation App in Test Run. You can check report. But When you try to execute it in production run. It will give Error “Advanced Valuation Active; you can no longer use the old report”.

Configuration for Advanced FCV

Whether you use the Configure Your Solution environment or Central Business Configuration you need to configure following items.

1. Financial Statement Version

Define Financial Statement Versions (ID: 102669)

(You can use an existing financial statement version or create a new one.)

2. Assign Financial Statement Version to Accounting Principle

Assign Financial Statement Versions to Accounting Principles (ID: 103215)

You need to assign a financial statement version. It could be standard delivered or custom created by you.

3. Assign Semantic Tags to Financial Statement Versions

Assign Semantic Tags to Financial Statement Versions (102659)

Generally, we use financial tag ‘FX’ which is delivered in standard. However, you can create your own and configure accordingly.

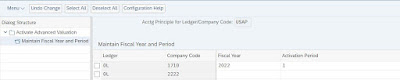

4. Advanced Valuation in Financial Accounting is active

Activate Advanced Valuation (ID: 103315)

You can control your activation at Ledger and Company Code combination level.

5. Aging and Aging Increment

Define Aging Increments for Advanced Valuation (ID: 103049)

SAP delivers the following aging with increments:

◉ SGLOBRCL: Aging for global AP reclassification (IFRS, USGAAP)

◉ S3IRCL: Aging for reclassification

Generally standard delivered aging(s) are sufficient but in case of need you can create the custom one.

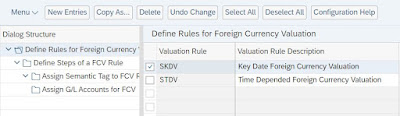

6. Rules for Advanced Foreign Currency Valuation

Define Rules for Advanced Foreign Currency Valuation (ID: 105450)

Note: Now you only need expense G/Ls configuration for Advanced Foreign currency valuation processes that also means you don’t need to configure on Source and Adjustment G/Ls such as Reconciliation G/Ls, Bank G/Ls etc.

So, how it works?

Financial Statement Version (Create/Use Existing) → Financial Statement Version Assigned to Accounting Principle → Financial Statement is Assigned to Semantic Tag (for Source G/Ls such as Reconciliation G/Ls, Bank G/Ls etc.) → FC Valuation Rule is assigned to Semantic Tag → FC Valuation Rule is assigned to Accounting Principle.

This process helps in finding the G/Ls on which FCV need to be perform.

7. Assign Rules for Advanced Foreign Currency Valuation to Accounting Principles

Assign Rules for Foreign Currency Valuation to Accounting Principles (ID: 105451).

Currency Concept in Advanced FCV

Settings for Foreign Currency Valuations

Advanced foreign currency valuation uses the document currency for valuations into the functional currency. If you have not defined a functional currency, then the valuation is done into company code currency.

Multicurrency Clearing

In multi-currency clearing, the cleared postings are balanced out considering the existing foreign currency valuations. These valuations will have amounts only in currencies with open positions remaining.

Valuation Method in Advance FCV

1. LOWEST_VALUELowest Value Principle: Valuation is posted only if there is loss situation considering initial values (e.g., invoice value)

2. STRICT_LOWEST_VALUEStrictly Lowest Value Principle: Valuation is posted only if the new valuation has a greater devaluation than the lowest value of valuations in previous periods.

3. ALWAYS_VALUATEAlways Valuate: Valuation is always posted whether loss or gain situation

4. GAIN_ONLYHighest Value Principle: Valuation is only posted if there is gain situation considering initial value (e.g., invoice value)

5. DE_BILMOG_VALUATEGerman Accounting Modernization Act: If you select this rule, the system combines the following rules:

ALWAYS_VALUATE and STRICT_LOWEST_VALUE

All current open items and groups of items with a net due date less than 1 year are always valuated. For noncurrent items with the net due date greater than 1 year, the strictly lowest value principle is applied.

Run – Advanced Foreign Currency Valuation

Advanced Foreign Currency Valuation template is run Schedule General Ledger Jobs App.

1. It is grouped transactions of related transactions such Invoice and Credit note and post effective balance to forex valuation posting

2. Transaction posted through Advanced Foreign Currency Valuation template will look like this

3. Document posted through this will not be seen in Manage Supplier Line Items or Manage Customer Line Items app. But it will be seen in Display Line Items in General Ledger app.

4. If you try to run Advanced Foreign Currency Valuation for company code and ledger combination which is not activated, you will get error like below

Schedule a Recurring Job with a Dynamic Valuation Key Date

If you want the system to dynamically calculate the valuation key date in recurring jobs, you must specify this using the recurrence pattern and the dynamic valuation key date or you can schedule as and when you want to run FCV process.

Sequence of Processes in Advanced Valuations

i. Post Discounting of Long-Term Assets and Liabilities

ii. Advanced Foreign Currency Valuation

iii. Post Credit-Risk Based Impairment

iv. Post B/S Reclassification

What happens to Classic Valuation Functions

Once you have activated Advanced Valuation you can no longer use the following apps:

◉ Perform Foreign Currency Valuation (FAGL_FCV)

◉ Regroup Receivables / Payables (FAGLF101)

◉ Perform Further Valuations (F107)

You can also no longer use the following job templates:

◉ Foreign Currency Valuation

◉ Regroup Receivables/Payables

◉ Provisions for Doubtful Receivables

If there are no postings in the productive system, you can deactivate Advanced Valuation in the Activate Advanced Valuation configuration item.

No comments:

Post a Comment